The FTSE 100 index is rapidly incorporating financial conspiracies, which are opening up great opportunities and new ideas in the money industry. The FTSE 100 and fintech will meet as 2024 approaches. For more information, see FTSE 100 FINTECHZOOM on search engines for the latest news, analysis, and information on financial services companies and change issues.

The article looks at how leading companies can update financial conspiracies in the FTSE 100 index.

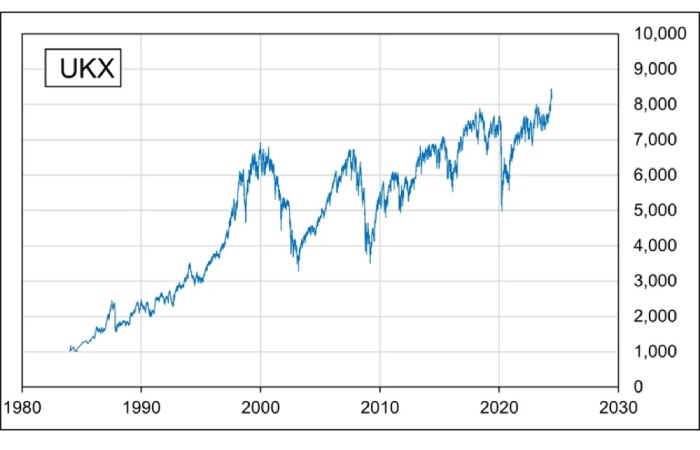

Historical Growth Analysis of FTSE 100 FintechZoom

The fintech sector has driven the very rise of the FTSE 100 over the past few years.

Companies in the financial industry have become very innovative, and most consumers find their products very convenient.

This contributed to the rise in share prices of most of these companies. Fintechzoom is one of the largest financial institutions offering innovative products and services.

Its reserves increased slightly. This tells investors what to expect from the company and the index in the future.

FintechZoom’s FTSE 100 Investment Strategies

FTSE 100FintechZoom provides investors with a great opportunity to expand their investment portfolios and earn good returns.

This is best achieved by choosing blue-chip companies that have relatively extensive experience and a proven track record of growth and stability.

Typically, this company survives in difficult economic conditions and does not pose much of a risk to investment.

Another good tactic is long-term investing, such as holding real estate for a very long time, where cumulative returns and dividends can generate profits.

This strategy avoids short-term market fluctuations that provide stable returns over time.

He is reinvesting dividends over time results in rapid growth of an investor’s investment portfolio so that he can achieve his financial goals and accumulate wealth over some time.

Overall, a long-term investment strategy is best suited for FTSE 100 FintechZoom investors to achieve their financial goals and build long-term wealth.

FintechZoom Impacts FTSE 100 Index

The success of FintechZoom has contributed to the growth of the FTSE 100 index, and so the rise in share prices proves that even a fintech company can influence the market.

Its growth attracted more investors who wanted to trade its shares, increasing volume and liquidity. This news has given investors confidence in companies related to the sector and thus prompted an increase in investment.

FintechZoom set the benchmark for other companies in this genre and pushed the idea that this industry is actually successful.

Analysis Of The FTSE 100 Index

Fintech companies in the FTSE 100 have seen their growth outpace more traditional financial industries.

Companies like PayPal and Square are seeing their stock prices rise rapidly due to growing demand for digital payment solutions.

Fintech sectors have demonstrated strong resilience and, over the long term, room for further growth.

PayPal has dominated the industry market, primarily through expansion into new markets and strategic partnerships.

Innovative products like Cash App and Square Capital have revolutionized revenue streams and attracted mass audiences.

Latest News And Updates On FTSE 100FintechZoom To Keep Up With

Fintech is expanding phenomenally, traditional partnerships with financial institutions and fintech businesses are having an impact, and regulatory reforms are having an effect – with FTSE 100 fintech companies such as Revolut and Adyen forming a marker of economic performance and market expansion. Follow the latest steps.

- Adyen has become a major player in the online payment processing industry, partnering with major companies around the world and expanding into new areas.

- Revolut has added new features such as stock and cryptocurrency trading, allowing more people to use their website and earn more money.

- New regulations, such as open banking and data protection, are changing the way fintech works and making them more difficult to comply with.

- The FTSE 100 ended a good week at a new record high as Anglo refused to buy it.

Future Trends Shaping The Next-Gen FTSE 100 FintechZoom

As mentioned, recent trends in FTSE 100FintechZoom will influence the future of FTSE 100 FintechZoom.

Below are some of the important trends that will further shape the future of the next generation of FTSE FintechZoom.

APIs And Open Banking FintechZoom

Open banking initiatives are transforming the financial sector by enabling seamless integration and promoting personalized services and innovative solutions.

FintechZoom FTSE 100 companies are also using APIs to create new financial products and services, increase competition, and increase transparency in financial markets.

Experts say this will improve the customer experience and change the face of finance forever.

Blockchain

Blockchain technology is varying the face of financial transactions, SCF, and payments.

FTSE 100 FintechZoom companies are already harnessing this disruptive force to become more efficient, secure, and trustworthy in a world where blockchain technology is evolving towards integration with FTSE 100 FintechZoom.

Cybersecurity

FTSE 100 listed companies have a critical focus on cybersecurity, mainly in relation to the financial sector, as sensitive information and transactions are involved.

Such companies are investing in advanced encryption, multi-factor authentication, and artificial intelligence-based threat detection capabilities.

This is also done to protect systems, networks, and customers from cyber threats that may affect them.

Simply put, this feature allows them to strengthen their cybersecurity position against ever-evolving threats.

Digital banking

Combined with innovative platforms such as AI-powered chatbots, mobile banking apps, and personalized insights into each customer’s financial situation, FintechZoom digital banking is transforming the banking business.

It redefines banking, makes banking more accessible and user-centric, sets new standards for how banks communicate with customers and enhances their customer experience.

Financial inclusion

Fintech innovation, which FTSE 100 companies can use to promote financial inclusion, is among the world’s most pressing challenges to provide affordable and convenient financial services to isolated or underbanked populations.

Innovations include mobile banking, online payment systems, microloans, and peer-to-peer lending.

When companies are committed to financial inclusion, poverty will decrease, and economic growth will increase.

Insurtech

Insurance is going digital, and companies belonging to a sector called Insurtech are using artificial intelligence, the Internet of Things, and data analytics to develop personalized insurance products, speed up claims settlement, and help better assess risks; this is how insurance companies operate and treat customers.

However, more significant changes in this area are yet to come. Giant leap expected from FTSE 100 FintechZoom.

Machine Learning And AI

Artificial intelligence and machine learning are transforming finance, helping FintechZoom companies create AI-powered strategies and optimize risk assessment and fraud detection.

They enable you to make informed decisions with lower operating costs and personalized customer service. Technology is changing, so its impact on the financial sector is set to grow exponentially.

Robo-advisors

Robo-advisors are revolutionizing the investment business by offering algorithm-based financial planning services.

Investment portfolio management advice or any other financial planning services that the platforms provide to their clients are also customizable.

Today, investing through these platforms has become more accessible and available at lower prices.

FTSE 100 companies FintechZoom will have robo-advisors as part of its offerings for more clients and improved wealth management services.

Final Thoughts

In conclusion, FintechZoom’s presence in the FTSE 100 FintechZoom Index will allow it to outperform most other companies both from a financial perspective and in terms of market trends.

This report covers everything an investor needs to make an informed investment decision, from in-depth analysis of the latest news and expert commentary to more.

In short, you now have your finger on the pulse of the FTSE 100 thanks to FintechZoom, meaning you have a competitive advantage over what’s happening in the world.

Many of the same news and ideas will help you choose the best investment strategies in your quest for financial success. Stay focused. For unlimited access to top economic news and trends, subscribe to FTSE 100 FintechZoom.

FAQ

What is the FTSE 100 index?

The FTSE 100 FintechZoom is a stock marketplace index consisting of the 100 largest companies registered on the London Stock Exchange by market capitalization.

How does FintechZoom help investors?

FTSE 100 FintechZoom provides real-time data, analytics and news to help investors make informed decisions based on timely information.

What are the main risks of investing in the FTSE 100?

Key risks include market volatility and cybersecurity issues.

Can new investors use FintechZoom?

Yes, FintechZoom is user-friendly and offers resources and tools suitable for both new and experienced investors.

How does FintechZoom predict market trends?

FTSE 100 FintechZoom uses advanced algorithms and machine learning to analyze market data and predict future market movements.